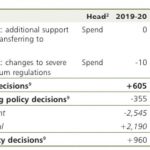

Content

You realize that a declining net profit margin isn’t good, but you wonder how you compare with your industry. A little research informs you that average net profit margin in the industry is 7 percent. You performed nearly as well as the industry in year 1 but fell further from your target in year 2. That a goal for year 3 should be trying to increase your net profit margin. By looking at the numbers provided by a company, you should see whether there are any large differences between one year and the next.

- Businesses can compare their performance with the industry’s average performance using these financial statements.

- You performed nearly as well as the industry in year 1 but fell further from your target in year 2.

- Consider the following example of comparative income statement analysis.

- Discuss the major similarities and differences in accounting for for-profit and not-for-profit organizations.

- Stock analysis is the evaluation of a particular trading instrument, an investment sector, or the market as a whole.

It helps in observing seasonality and growth patterns in an easy way. Moreover, it is also known as Trend Analysis due to its ability to analyse trends. Comparative Income Statement or comparative statement is a financial statement that defines the current financial position of a business and compares it with prior period statements.

Comparative financial statements in which each amount is compared to a base year are called…

Additionally, it can also be used for timeline analysis by assessing individual statements for a reporting period. You’re an expert at running your business, not analyzing financial numbers. But as a small business owner, you need to know how your decisions affect your company. By reviewing your accounting books, you can leverage data to grow your company.

A Statement of Profit & Loss or Income Statement shows the profit earned or loss incurred by an organisation during the year. However, a Comparative Income Statement or Comparative Statement of Profit & Loss is a horizontal analysis of the Income Statement showing operating results for more than one accounting year. In simple terms, it shows the absolute change and percentage change in the figures from one period to another. Next, study Column , which expresses as a percentage the dollar change in Column . Frequently, these percentage increases are more informative than absolute amounts, as illustrated by the current asset changes.

4 Financial Statement Analysis

He must analyse the liquidity and solvency position, profitability position, Capital structure position, as well as on management efficiency position. A comparative Balance Sheet presents emphasis on changed value of assets and liabilities whereas a Single Balance Sheet presents the emphasis on status for ascertaining financial positions. GAAP approach to the IFRS approach of translating foreign currency financial statements. Determine the main similarities and differences between the two methods of translation.

Business investors use comparative income statements to look at different companies. The comparison helps them decide which business is a better investment. A vertical, or common-size, analysis looks at the relative size of line items. It allows you to compare income statements from different-sized companies. To compare competing businesses, find the percentage of revenue for each line item.

1: Analyzing Comparative Financial Statements

A comparative Balance Sheet is very useful for finding out the trend analysis. Because we know that the financial performance of a firm cannot accurately be judged by studying one or two years Balance Sheets. Trend analysis of comparative Balance Sheets highlights many useful information to the users of financial statements. Restatement of financial statements should be a red flag to investors and lenders. Also, the revisions to comparative financial statements and disclosure notes. These ratios reveal the way in which assets are being used to generate income .

Usually, the entities included in the comparative financial statements include balance sheets, profit and loss accounts, and cash flow statements for two consecutive years. A comparative income statement combines information from several income statements as columns in a single statement. It helps you identify financial trends and measure performance over time. You can compare different accounting periods from your records. Or, you can compare your income statement to other companies.

Income Statement

Such a financial statement is based on the financial data of at least two periods, usually a year. First, such statements are often useless when comparing two businesses’ financial figures because a common base does not exist. IFRS specifies the periods for which comparative financial information is required, which example of comparative financial statement differs from US GAAP requirements. It is a relatively more potent tool than horizontal analysis, which shows the corresponding changes in the finances of a particular unit/ account/department over a certain period of time. Income statement, every line item is stated in terms of the percentage of gross sales.

What are comparative financial statements?

Comparative statements or comparative financial statements are statements of financial position of a business at different periods. These statements help in determining the profitability of the business by comparing financial data from two or more accounting periods.

What are 3 examples of financial statements?

The three major financial statement reports are the balance sheet, income statement, and statement of cash flows.